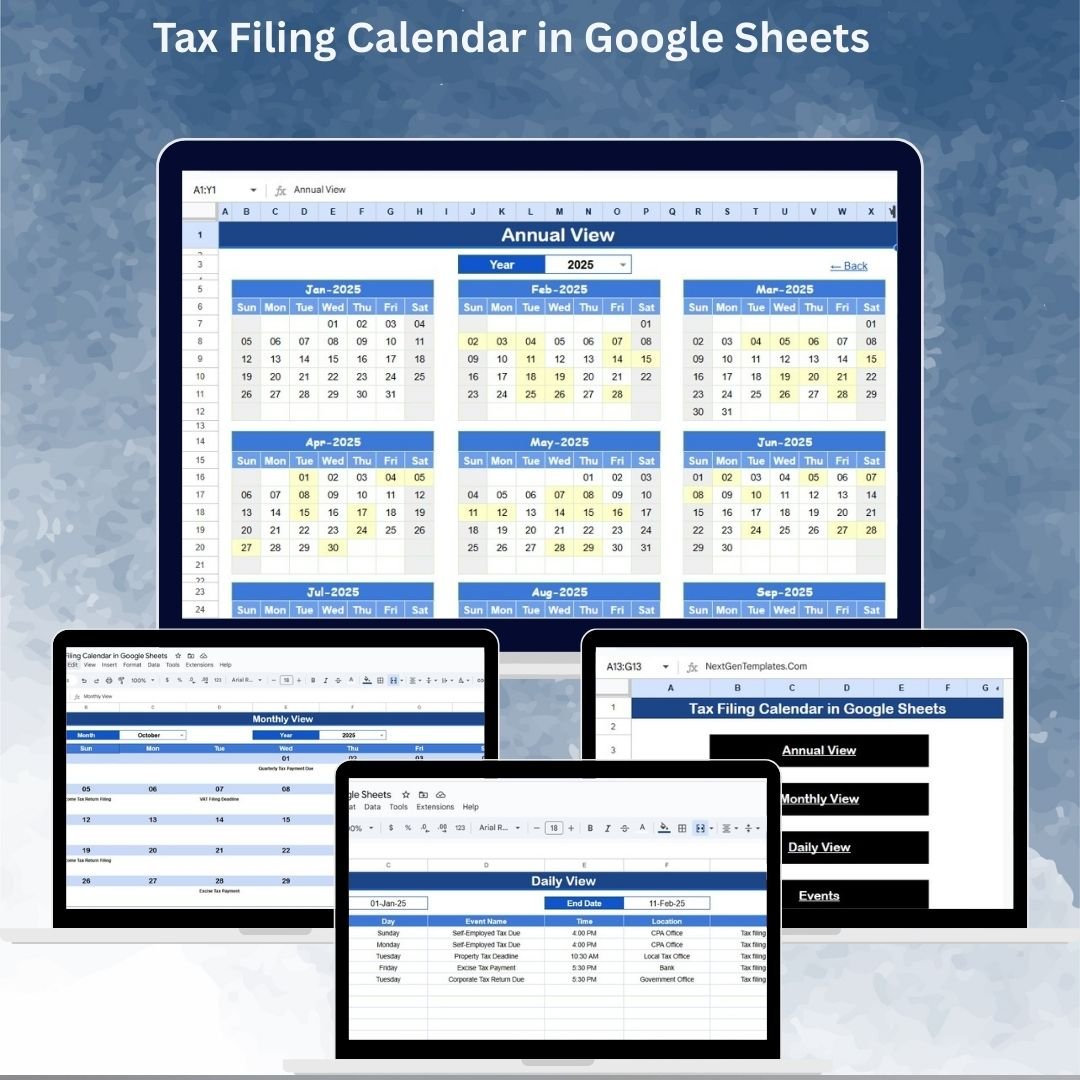

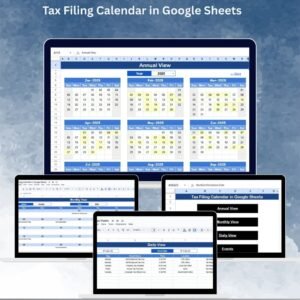

Managing tax filing deadlines can be stressful, especially when juggling multiple compliance dates across months and years. Missing just one deadline can lead to penalties, unnecessary stress, and last-minute rushes. That’s why we created the Tax Filing Calendar in Google Sheets — a ready-to-use, interactive template designed to keep businesses, accountants, and finance teams on track. ✅

This simple yet powerful tool provides annual, monthly, and daily calendar views, along with a centralized events database, so you never miss an important filing. Fully cloud-based and collaborative, it ensures your team stays aligned, organized, and compliant.

🔑 Key Features of Tax Filing Calendar

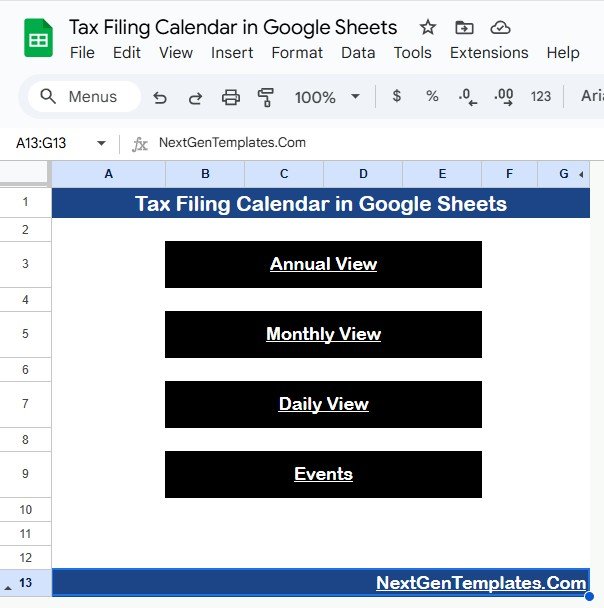

🏠 Home Sheet Tab

-

Acts as the index sheet for easy navigation.

-

Includes buttons to jump directly to Annual View, Monthly View, Daily View, and Events Sheet.

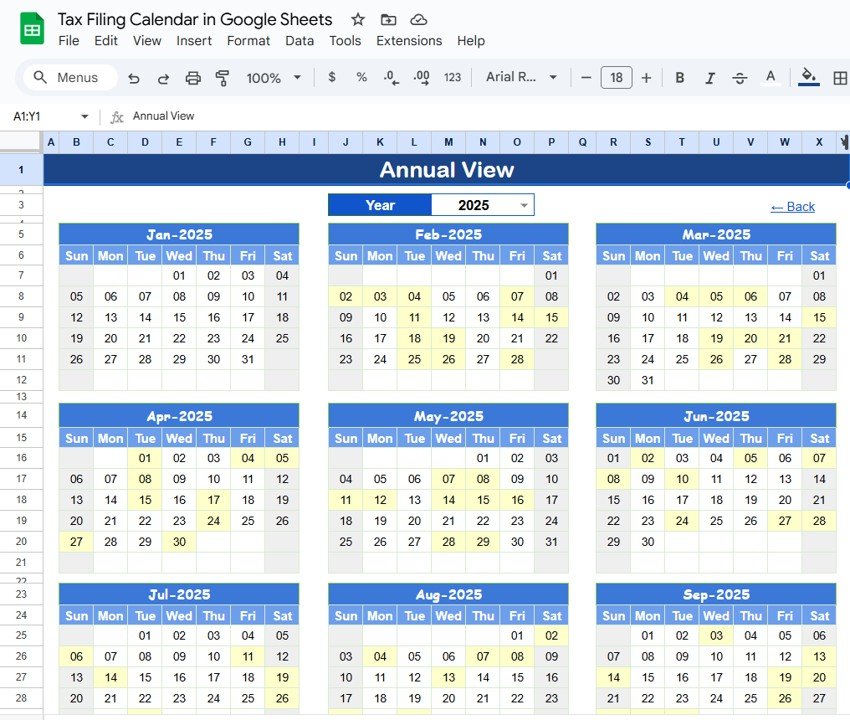

📅 Annual View Sheet Tab

-

Displays all 12 months of the year in one place.

-

Customize the year, starting month, and first day of the week based on your region.

-

Provides a complete overview of tax deadlines throughout the year.

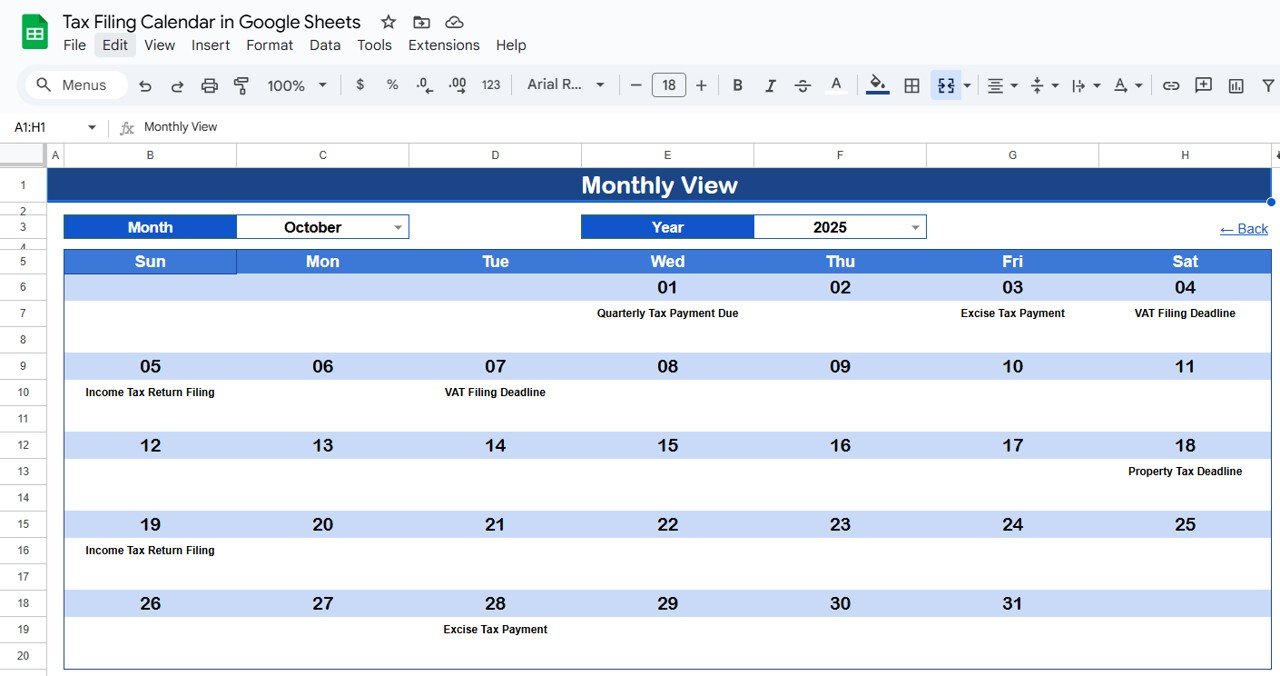

🗓️ Monthly View Sheet Tab

-

Shows the selected month with all scheduled tax events.

-

Automatically updates based on the chosen month and year.

-

If multiple events fall on the same day, it displays “more than 1…” for clarity.

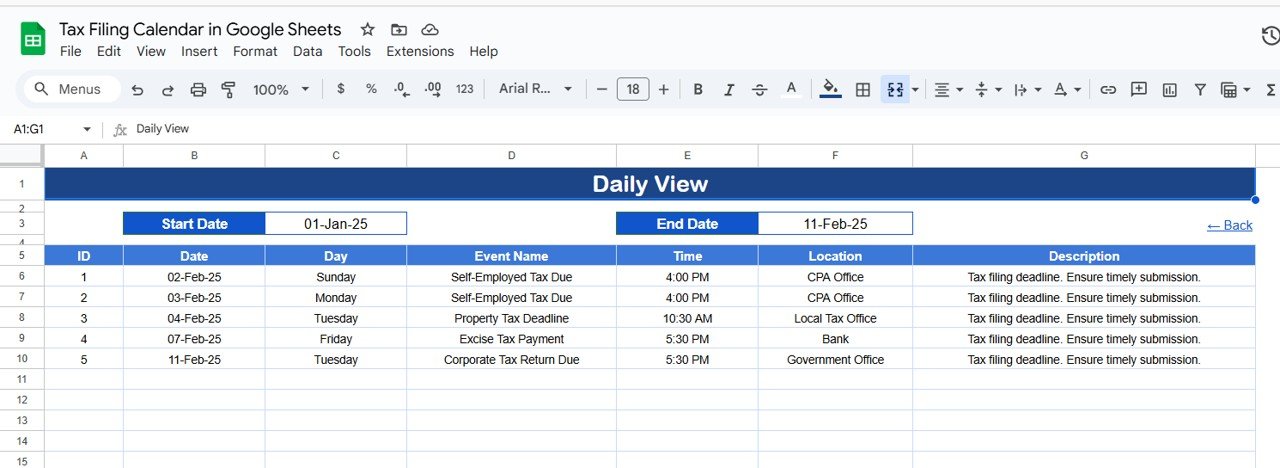

📋 Daily View Sheet Tab

-

Provides a detailed list of events within a selected date range.

-

Use start and end date filters with a calendar icon for convenience.

-

Perfect for reviewing specific deadlines and tasks on a daily basis.

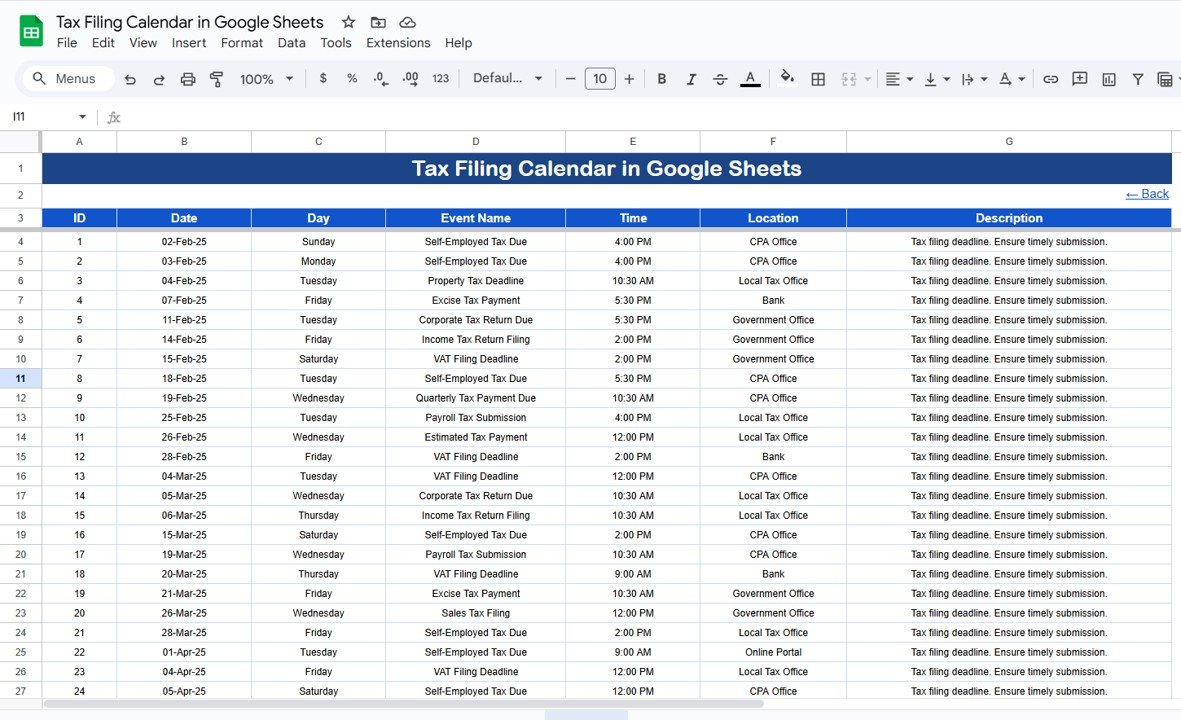

🧾 Events Sheet Tab

-

The database where all tax-related events are stored.

-

Captures details like:

-

ID (unique identifier)

-

Date & Day

-

Event Name (tax filing or compliance event)

-

Time

-

Location (venue or online link)

-

Description (short notes for context)

-

-

Updates automatically reflect across all views.

📦 What’s Inside the Tax Filing Calendar

✅ 5 Pre-Built Tabs: Home, Annual View, Monthly View, Daily View, Events

✅ Fully Interactive & Auto-Updating

✅ Multi-Level Views (Annual, Monthly, Daily)

✅ Centralized Event Database for all tax filings

✅ Cloud-Based for Real-Time Collaboration

✅ Simple, Professional, and Easy-to-Use Design

👥 Who Can Benefit from This Calendar?

💼 Accountants & Finance Teams – Plan and track client tax deadlines.

🏢 Business Owners – Avoid missed compliance dates and penalties.

👨💻 Tax Consultants – Manage multiple clients with clarity.

📊 Corporate Finance Departments – Maintain organizational compliance efficiently.

📅 Individuals – Track personal tax deadlines with ease.

This tool is designed for anyone managing tax filing obligations at personal, business, or corporate levels.

📋 Best Practices for Using the Tax Filing Calendar

-

🔄 Update Events Regularly: Add upcoming tax deadlines as soon as they are known.

-

📅 Check Monthly View: At the start of each month, review deadlines in advance.

-

🔍 Use Filters: Narrow down specific dates in the Daily View.

-

✅ Track Completion: Add notes or update descriptions when filings are complete.

-

👥 Collaborate: Share access with your finance team for transparency.

-

💾 Keep Records: Maintain historical events for audit purposes.

✅ Advantages of Tax Filing Calendar

-

Never Miss Deadlines – Clear visibility of all filing dates.

-

Multi-Level Views – Annual, monthly, and daily perspectives.

-

Customizable – Adjust year, month, and starting day for flexibility.

-

Centralized Database – Store all events in one sheet.

-

User-Friendly – Easy navigation with clickable buttons.

-

Collaboration Ready – Multiple users can access in real time.

Reviews

There are no reviews yet.