The Payroll Processing Calendar in Excel is a streamlined, easy-to-use tool designed to help HR departments, payroll managers, and business owners effectively manage and track their payroll schedule. This Excel-based calendar ensures that all payroll-related activities, such as tax calculations, deductions, and pay dates, are accurately recorded and processed on time.

This calendar provides a clear, organized overview of payroll activities, ensuring that all payroll deadlines are met, and payroll processes run smoothly without missing any important tasks. Whether you are a small business or a large organization, this tool is customizable to meet your payroll processing needs, making it easier to track important milestones and ensure compliance with regulatory requirements.

Key Features of the Payroll Processing Calendar in Excel

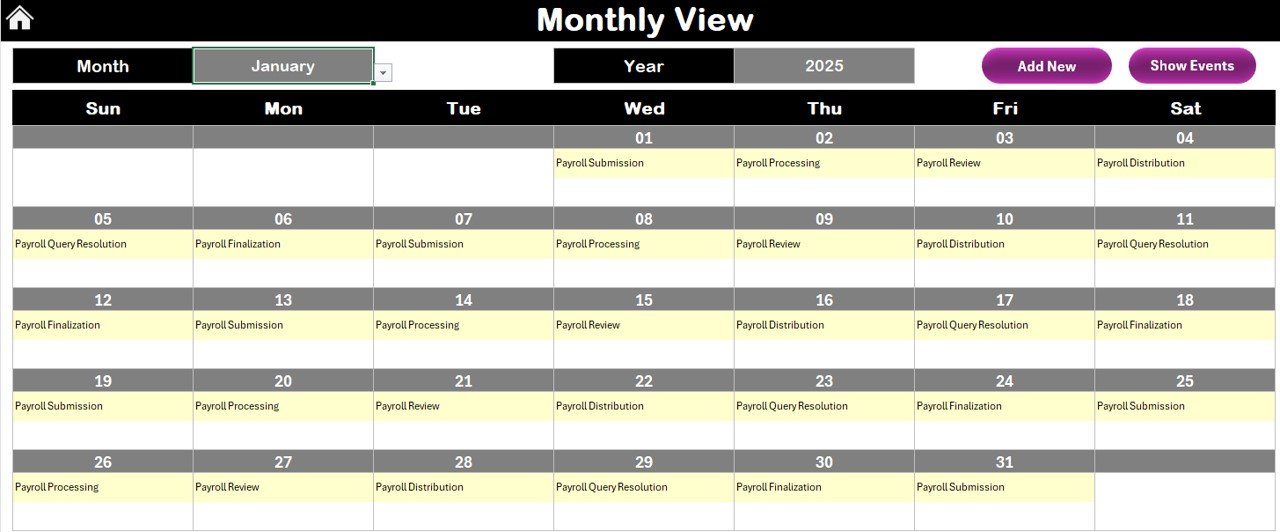

📅 Comprehensive Payroll Scheduling

Organize payroll dates, pay periods, and deadlines in one simple calendar. Track the pay dates, tax deadlines, and other important milestones to ensure timely payroll processing.

📝 Deductions & Contributions Tracking

Track tax deductions, employee benefits, and contributions (like retirement funds, health insurance, etc.). This ensures that all necessary deductions are calculated correctly, avoiding any compliance issues.

📊 Payroll Data & History

Keep a record of each payroll cycle, including details of payments made, tax calculations, and any adjustments. This makes it easier to access past payroll information for audits and reports.

⏱ Automated Alerts & Notifications

Set up reminders and automated notifications for important payroll tasks such as payment processing, tax filing, and employee reimbursements, ensuring no deadline is missed.

⚙️ Customizable & Scalable

Tailor the calendar to fit your company’s payroll structure. Add custom pay periods, different types of deductions, or adjust the calendar for multiple locations or departments.

📈 Reporting & Analytics

Generate payroll-related reports for better financial management. Analyze trends in payroll expenses, tax withholdings, and other payroll metrics to improve budget planning.

Why You’ll Love the Payroll Processing Calendar in Excel

✅ Simplifies Payroll Management

Easily track payroll dates, deductions, and tax deadlines all in one place. The calendar keeps everything organized, so you never miss a deadline.

✅ Accurate & Timely Payroll Processing

Track every payroll-related task and ensure that all deadlines are met on time, reducing the risk of errors and compliance issues.

✅ Seamless Deductions & Benefits Management

Track all necessary employee benefits and deductions such as retirement contributions, health insurance, and other benefits with ease.

✅ Customizable for Any Organization

Adapt the calendar to your payroll processing needs, whether you run a small business or a large corporation with complex payroll structures.

✅ Enhanced Reporting & Compliance

Generate detailed payroll reports for audits, budget planning, or financial analysis. Stay compliant with tax and reporting regulations by keeping accurate records.

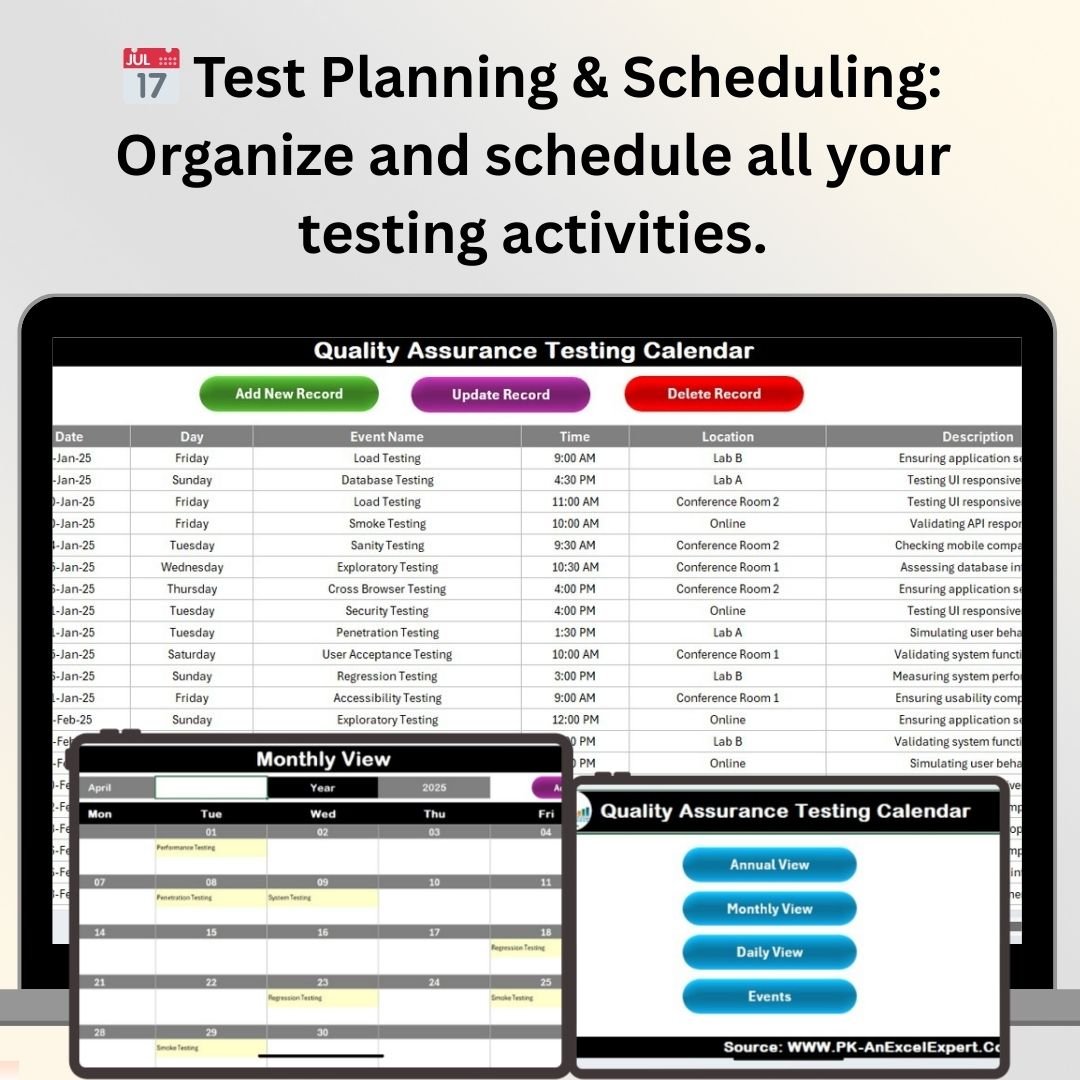

What’s Inside the Payroll Processing Calendar in Excel?

-

Payroll Scheduling: Track pay dates, pay periods, and tax deadlines.

-

Deductions & Contributions Tracking: Monitor tax deductions, insurance premiums, and other employee benefits.

-

Payroll History & Recordkeeping: Keep a log of each payroll cycle for reporting and compliance purposes.

-

Automated Alerts & Notifications: Get reminders for important payroll tasks and deadlines.

-

Customizable Features: Adjust the calendar for different payroll structures and business needs.

-

Reporting & Analytics: Generate detailed reports and analyze payroll data for better financial planning.

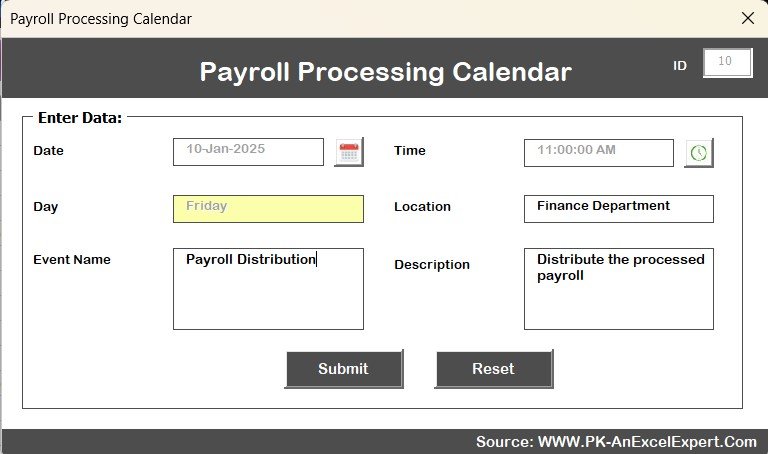

How to Use the Payroll Processing Calendar in Excel

1️⃣ Download the Template: Access the Payroll Processing Calendar in Excel instantly.

2️⃣ Input Payroll Data: Enter payroll dates, tax deadlines, and employee deduction information.

3️⃣ Track Deadlines & Deductions: Monitor payroll deadlines and calculate employee deductions with ease.

4️⃣ Set Up Alerts & Reminders: Automate notifications for important payroll events.

5️⃣ Generate Reports & Track Trends: Use the reporting tools to generate payroll reports and analyze data trends.

Who Can Benefit from the Payroll Processing Calendar in Excel?

🔹 Payroll Managers & HR Departments

🔹 Business Owners & Finance Teams

🔹 Small & Medium Enterprises (SMBs)

🔹 Large Corporations with Complex Payroll Structures

🔹 Accountants & Financial Analysts

🔹 Tax Professionals & Auditors

Ensure a seamless and efficient payroll process with the Payroll Processing Calendar in Excel. Stay on top of deadlines, track deductions, and maintain compliance—all in one simple tool.

Click here to read the Detailed blog post

Visit our YouTube channel to learn step-by-step video tutorials

Youtube.com/@PKAnExcelExpert

Reviews

There are no reviews yet.