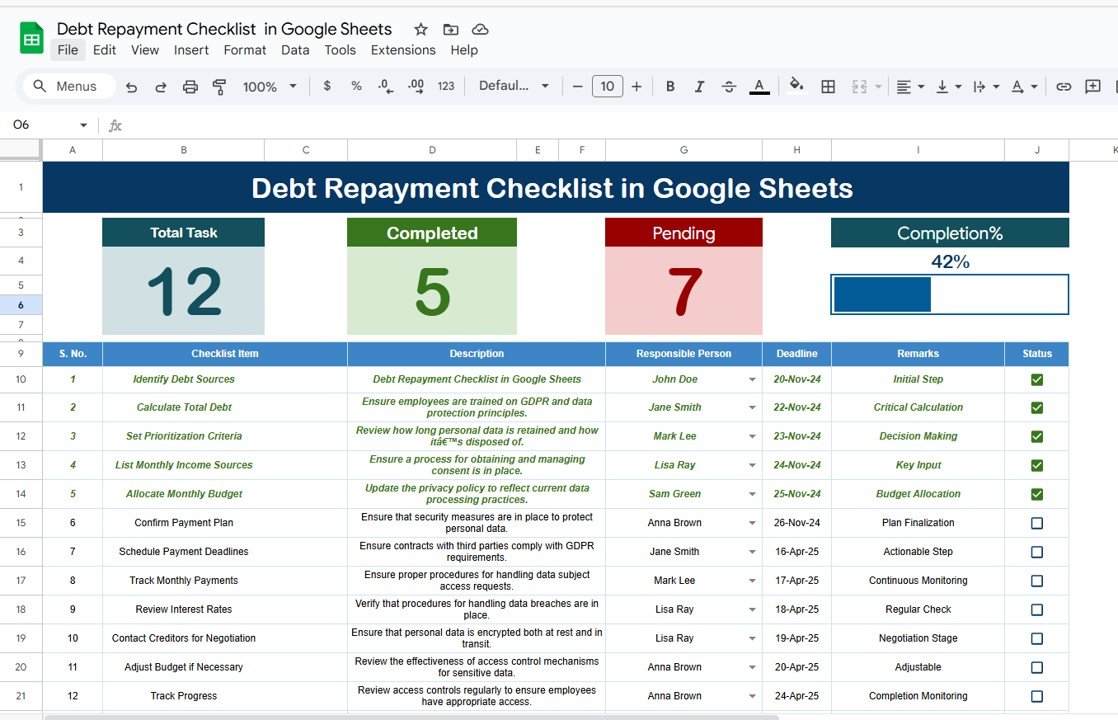

Managing debt can be stressful, but with the right tool, it becomes manageable—and even empowering. Introducing the Debt Repayment Checklist in Google Sheets—a simple yet powerful tracker that helps you stay organized, stay accountable, and stay on top of every debt payment. 💰✅

Whether you’re paying off personal loans, business credit cards, or vendor invoices, this ready-to-use template helps you track repayments, monitor deadlines, assign responsibilities, and measure your progress with visual clarity. Built in Google Sheets, it’s accessible, collaborative, and fully customizable for your unique debt repayment plan.

✨ Key Features of Debt Repayment Checklist

📋 Debt Repayment Checklist Sheet – Your Main Tracking Hub

Easily record and manage every debt with structured fields:

-

Serial No. – Auto-numbered entries for each debt

-

Checklist Item – Name or title of the debt (e.g., Credit Card, Loan A)

-

Description – Additional details (e.g., creditor, terms, type)

-

Responsible Person – Assign tasks using dropdowns

-

Deadline – Clearly mark when each repayment is due

-

Remarks – Add notes, payment status, or reminders

-

Status – Use ✔ for paid and ✘ for pending to monitor progress

📈 Progress Indicators at the Top

Visually track repayment progress with automatic:

-

✅ Total Count – Total debt items listed

-

✔️ Completed Count – Debts fully paid

-

❌ Pending Count – Debts still due

-

📊 Progress Bar – Color-coded visual showing how far you’ve come

📄 List Sheet – Manage Dropdown Options

Simplify data entry with a customizable list of responsible persons or departments.

Changes here reflect instantly in the main sheet’s dropdown for accountability.

📂 What’s Inside the Google Sheets Template?

This tool includes 2 interconnected worksheets:

1️⃣ Debt Repayment Checklist Sheet – Main interface for entering and monitoring debt repayments

2️⃣ List Sheet – Backend list of responsible persons (used in dropdowns for task assignment)

All fields are editable, and you can add as many entries or people as needed. The progress bar and cards update in real-time with every status change.

👥 Who Can Benefit from This Product?

This tracker is perfect for:

✅ Individuals – Track personal loans, student debt, or credit card balances

✅ Startups – Manage business expenses, vendor dues, and financing repayments

✅ Finance Teams – Maintain internal visibility and team accountability

✅ Family Budgeters – Collaborate with partners or household members to eliminate debt

Whether you’re working solo or as part of a team, this template makes debt tracking clear and actionable.

Reviews

There are no reviews yet.