Financial audits are critical for ensuring transparency, accountability, and compliance in every organization. But without a structured system, audits can quickly become overwhelming, leading to missed tasks, confusion, or non-compliance issues. The Financial Audit Outline Checklist in Excel solves this problem by providing a ready-to-use, organized, and easy-to-manage template for financial audit preparation and execution.

This Excel-based checklist is more than just a list—it’s a digital audit management system that ensures every task is captured, responsibilities are assigned, deadlines are set, and progress is tracked in real-time. Whether you are a small business or a large enterprise, this template adapts to your needs and provides a professional framework for managing audits seamlessly.

✨ Key Features of the Financial Audit Outline Checklist

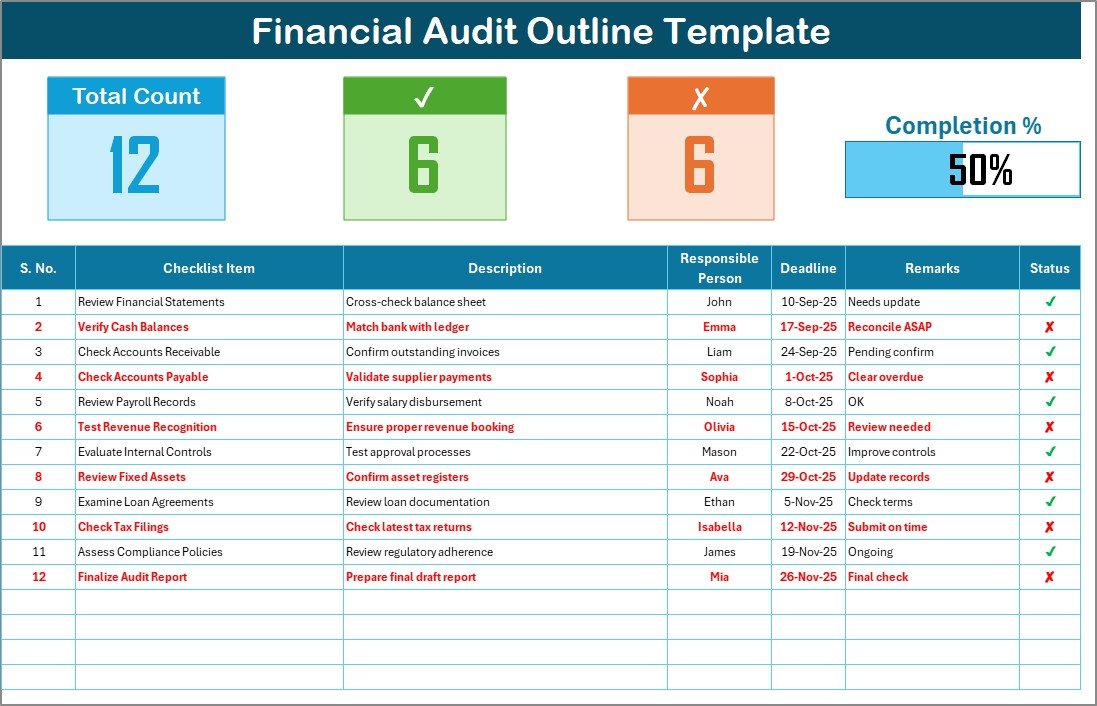

✅ Main Checklist Sheet

-

Centralized table for capturing all audit tasks.

-

Displays total tasks, completed tasks, pending tasks, and a visual progress bar.

-

Columns include Serial No., Checklist Item, Description, Responsible Person, Deadline, Remarks, and Status (✔ / ✘).

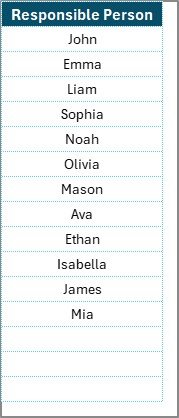

✅ List Sheet Tab

-

Stores a unique list of responsible persons.

-

Supports drop-down menus in the checklist for easy task assignment.

-

Reduces duplication and errors while ensuring accountability.

✅ Progress Tracking

-

Automatically updates counts of completed and pending tasks.

-

Visual progress bar provides instant audit readiness status.

✅ Customizable & Flexible

-

Add or remove audit tasks based on scope.

-

Modify deadlines, responsible persons, or remarks easily.

-

Beginner-friendly—no advanced Excel knowledge required.

📦 What’s Inside the Template

-

Financial Audit Outline Checklist Sheet – The main working sheet with progress tracking.

-

List Sheet – A reference sheet with responsible persons for easy drop-down assignment.

-

Prebuilt Sample Checklist Items – Helps you get started quickly with common audit steps.

🛠️ How to Use the Financial Audit Outline Checklist

-

Download & Open – Enable editing in Excel.

-

Fill Audit Items – Add tasks such as “Verify General Ledger” or “Check Tax Compliance.”

-

Assign Responsibility – Select team members from the drop-down menu.

-

Set Deadlines – Enter realistic completion dates.

-

Track Progress – Mark ✔ when completed or ✘ when pending.

-

Review Progress Bar – Analyze overall audit readiness at a glance.

-

Finalize Audit – Once all items are ✔, share the checklist with auditors or management.

👩💼 Who Can Benefit from This Checklist?

-

Finance Teams – To stay audit-ready and ensure compliance.

-

Internal Auditors – To track responsibilities and avoid missed steps.

-

Small Businesses – To maintain financial transparency without costly software.

-

Large Enterprises – To assign tasks across departments efficiently.

-

Consultants & Audit Firms – To manage multiple client audits.

🚀 Advantages of Using the Financial Audit Outline Checklist

-

Organized Workflow – All audit steps captured in one file.

-

Clear Accountability – Assign tasks with deadlines and responsible persons.

-

Time-Saving – Reduces duplicate efforts and manual tracking.

-

Real-Time Tracking – Progress bar and task counts show instant readiness.

-

Error Reduction – Prevents missing critical steps in the audit.

-

Compliance Assurance – Covers all mandatory financial checks.

-

Customizable – Adaptable for different audit cycles and industries.

📈 Opportunities for Improvement

-

Add conditional formatting to highlight overdue tasks.

-

Link supporting documents (e.g., financial reports, tax filings).

-

Use VBA macros to automate progress updates.

-

Build a dashboard sheet with charts and audit KPIs.

-

Store on OneDrive or Google Drive for team collaboration.

✅ Best Practices for Using the Checklist

-

Keep checklist items short and clear.

-

Update the file regularly during audit cycles.

-

Use colors to highlight urgent or overdue items.

-

Share the file securely with all stakeholders.

-

Archive completed checklists for compliance history.

-

Break long audits into phases for milestone tracking.

🏆 Real-World Applications

-

SMEs – Use it to prepare for external audits.

-

Corporates – Manage cross-departmental audit responsibilities.

-

Nonprofits – Maintain donor trust through transparent financial reporting.

-

Consulting Firms – Apply it across multiple client audits.

Reviews

There are no reviews yet.