In a world full of expenses, subscriptions, and spontaneous spending, it’s more important than ever to track your finances accurately. That’s where the Personal Finance Tracker in Excel comes in—a secure, automated, and customizable tool built with Excel and VBA, designed for everyday individuals who want to master their money without complex apps.

Whether you’re budgeting for a family, managing side income, or planning for long-term goals, this tracker simplifies it all with dynamic dashboards, user-friendly forms, and real-time insights.

⚙️ Key Features of the Personal Finance Tracker

🔐 1. Login Form for Secure Access

Start with a login screen to ensure your financial records remain private. Default login credentials are provided and fully customizable through a user management panel.

🧭 2. Main Form (Control Center)

From the main form, users can easily add, update, or delete financial entries. Navigate to dashboards or list sheets with just one click.

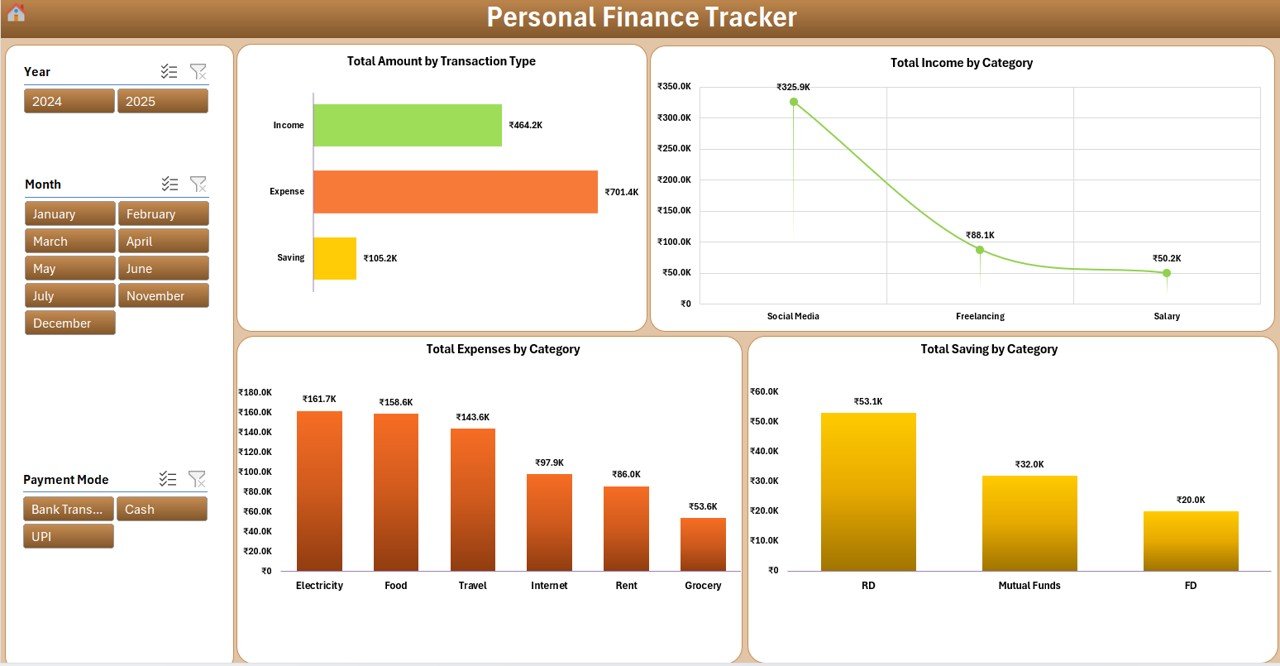

📊 3. Interactive Dashboard Sheet

Instantly visualize your money flow using:

-

💸 Total by Transaction Type (Income/Expense/Saving)

-

📈 Total Income, Expenses, and Savings by Category

-

📆 Filters by Month, Year, and Transaction Type

All charts update automatically upon data entry.

🧾 4. Data Entry Sheet

A structured backend table with fields such as:

-

ID, Date, Transaction Type, Category

-

Payment Mode, Amount, Description, Remarks

-

Auto-filled Month and Year columns

Add, edit, or delete entries using smart buttons.

🗂️ 5. Manage List Sheet

Control your dropdown options for:

-

Transaction Types (Income, Expense, Saving)

-

Custom Categories and Payment Modes

Ensures cleaner data and faster entry.

🧠 6. Support Sheet (Hidden Calculations)

Handles pivot tables and dashboard logic. No need to touch this—just let it power your visuals.

👥 7. User Management Panel

Create, delete, or modify users and passwords—perfect for shared financial planning.

🎯 Who Should Use This?

This tool is ideal for:

-

👨💼 Freelancers & self-employed individuals

-

👪 Families and home budgeters

-

🧑🎓 Students tracking pocket money or loans

-

💼 Small business owners managing dual incomes

-

👫 Couples managing shared expenses

💡 Why Choose Excel Over Budgeting Apps?

-

✅ 100% Offline Access – No Wi-Fi? No problem.

-

✅ No Subscription Fees – Pay once, use forever.

-

✅ Complete Flexibility – Add new sheets, charts, or columns easily.

-

✅ Enhanced Privacy – Keep your data on your device.

📚 How to Use the Tracker – Step-by-Step

-

Login with your credentials

-

Add a Transaction using the data entry form

-

Review Dashboard for updated income, expenses, and savings

-

Edit/Delete Entries as needed from the Data Entry sheet

-

Customize Lists via the Manage List sheet

-

Check Progress Monthly using dashboard filters and charts

🛠️ Best Practices for Success

✔️ Record transactions regularly

✔️ Use consistent category names

✔️ Filter data monthly to find trends

✔️ Update passwords for multi-user access

✔️ Back up your file before major changes

📝 Real-World Use Cases

-

✈️ Travel Budgeting – Plan and save for upcoming vacations

-

🧾 Utility Bill Tracking – Monitor recurring bills like electricity, rent, or broadband

-

💼 Side Income Management – Track freelance projects or small business revenue

-

🏦 Emergency Funds – Visualize your progress toward long-term savings

🔗 Bonus: Watch the Step-by-Step Tutorial

👉 youtube.com/@PKAnExcelExpert

Reviews

There are no reviews yet.