In the insurance and finance industries, precision, risk assessment, and predictive analysis are everything. Actuaries handle massive volumes of data — from premiums and claims to satisfaction scores and reserves — to ensure organizations stay profitable and compliant.

The Actuarial Services Dashboard in Excel is a ready-to-use analytical solution that transforms raw actuarial data into clear, actionable insights. Built for actuaries, insurance professionals, and risk managers, this Excel-based dashboard helps track, visualize, and interpret key performance indicators (KPIs) across multiple dimensions — including claims management, policy analysis, and risk exposure.

By combining Excel’s flexibility with automated analytics, this tool enables professionals to make faster, more data-driven decisions without relying on expensive BI software.

⚙️ Key Features of the Actuarial Services Dashboard in Excel

📊 5 Analytical Pages – Overview, Company Name, Policy Type, Region, and Monthly Trends.

🧭 Page Navigator – Switch between dashboards effortlessly via left-side navigation.

📈 Dynamic KPIs – Total Claims, Premium Amount, Combined Ratio %, and Customer Satisfaction.

💡 Interactive Charts – Drill down into risk categories, claim approvals, and performance ratios.

🎯 Actual vs Target Visualization – Compare results against business benchmarks.

🌍 Regional Risk Mapping – Identify high-risk or high-profit geographies.

📅 Monthly Trend Tracking – Detect seasonal variations in claims and premiums.

📘 Support & Data Sheets – Maintain reference data and raw inputs cleanly.

📤 Customizable Format – Add KPIs, adjust formulas, or integrate with databases easily.

🧭 Dashboard Structure Overview

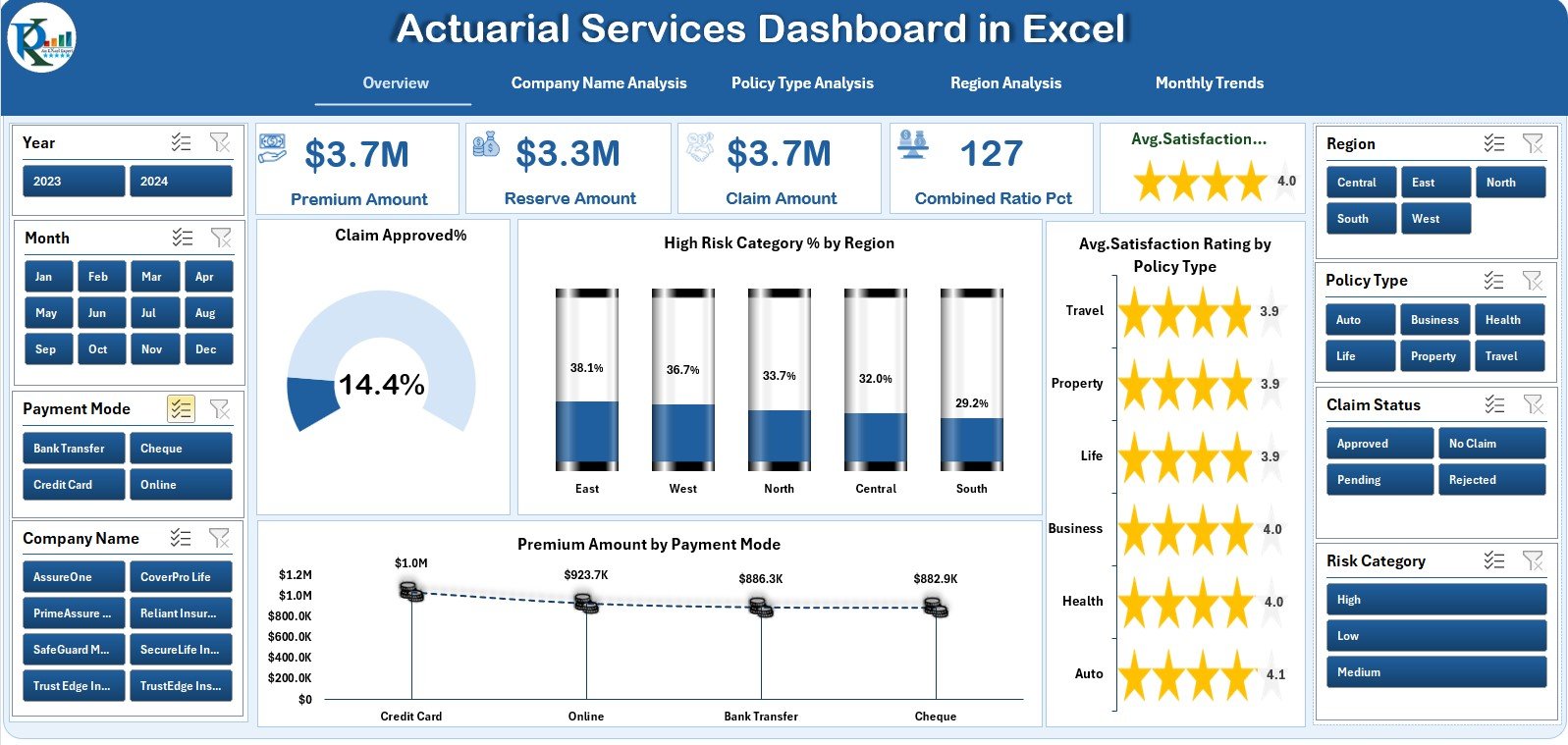

🏠 1️⃣ Overview Page — Central Insight Hub

The main page features five key KPI cards (Total Claims, Premiums, Customer Satisfaction, etc.) and four interactive charts:

-

Claim Approved %

-

High-Risk Category % by Region

-

Premium Amount by Payment Mode

-

Average Satisfaction by Policy Type

💡 Purpose: Get a one-glance, 360° performance summary of actuarial operations.

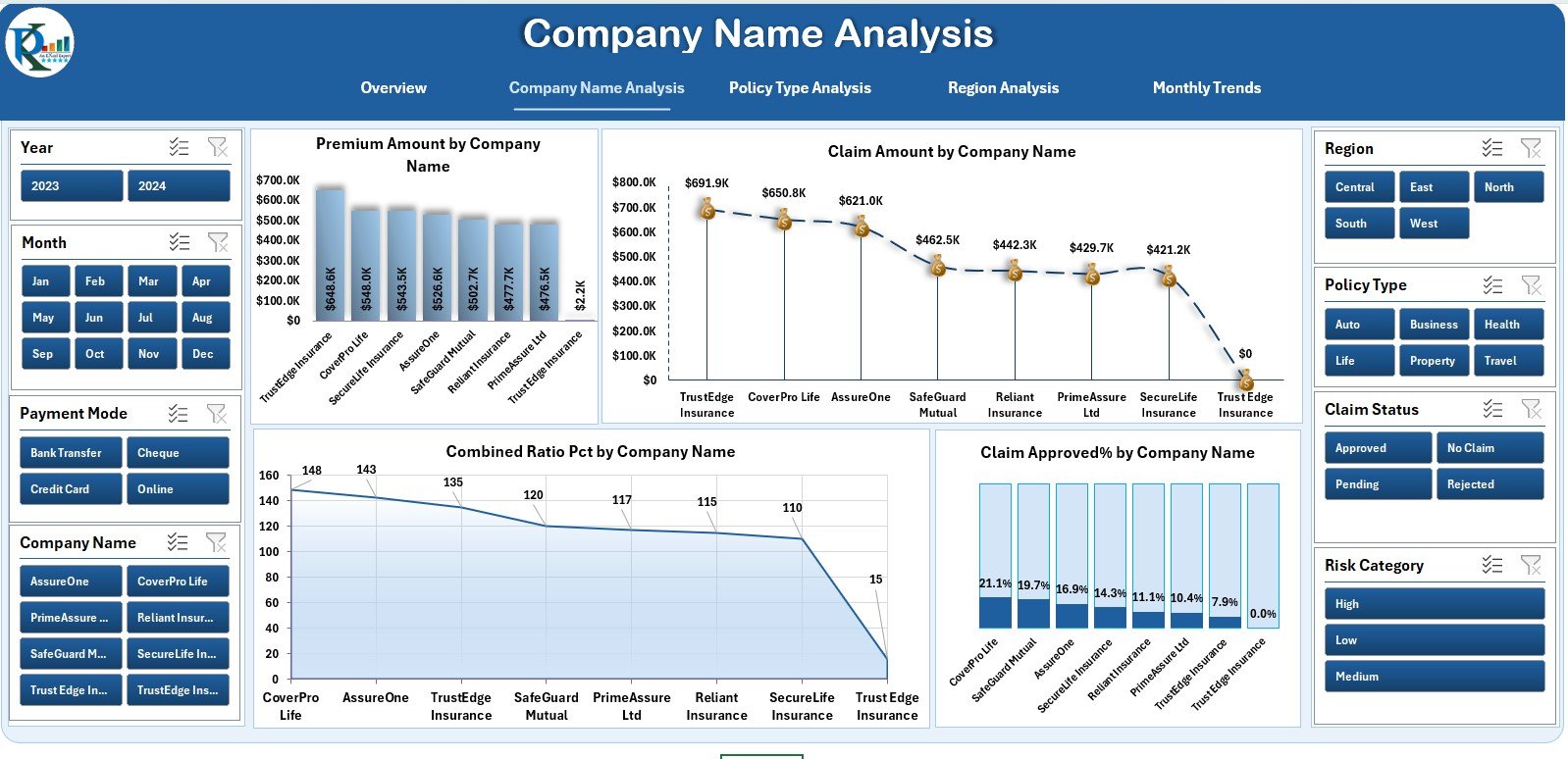

🏢 2️⃣ Company Name Analysis — Compare Insurer Performance

Analyze multiple insurers with four comparative visuals:

-

Premium Amount by Company

-

Claim Amount by Company

-

Combined Ratio (%) by Company

-

Claim Approved % by Company

🎯 Purpose: Benchmark insurer efficiency and identify improvement areas.

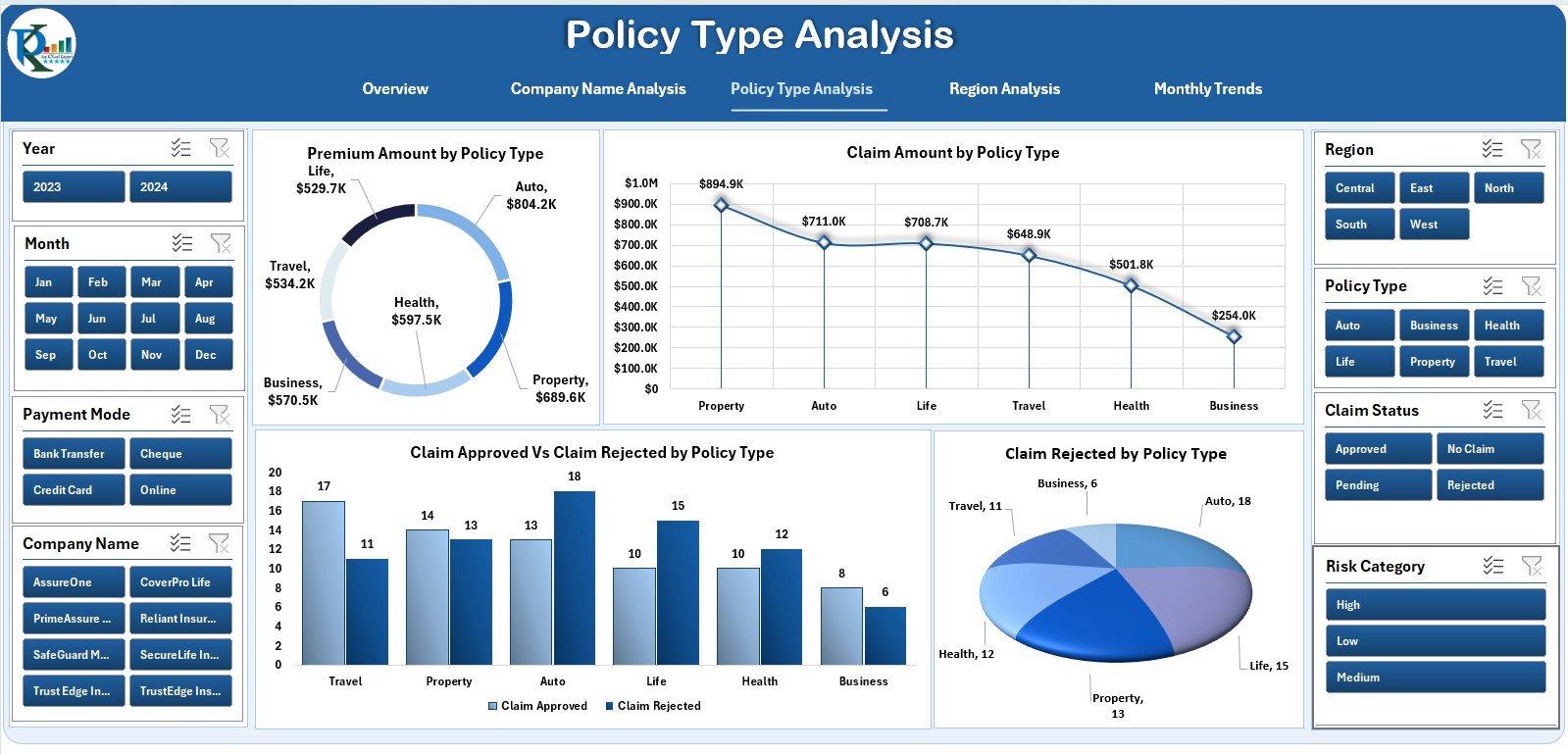

🧾 3️⃣ Policy Type Analysis — Evaluate Policy Effectiveness

Understand how each policy type performs:

-

Premiums and Claims by Policy Type

-

Claim Approved vs Rejected %

-

Rejected Claims by Category

💡 Purpose: Reveal which products are most profitable or risky.

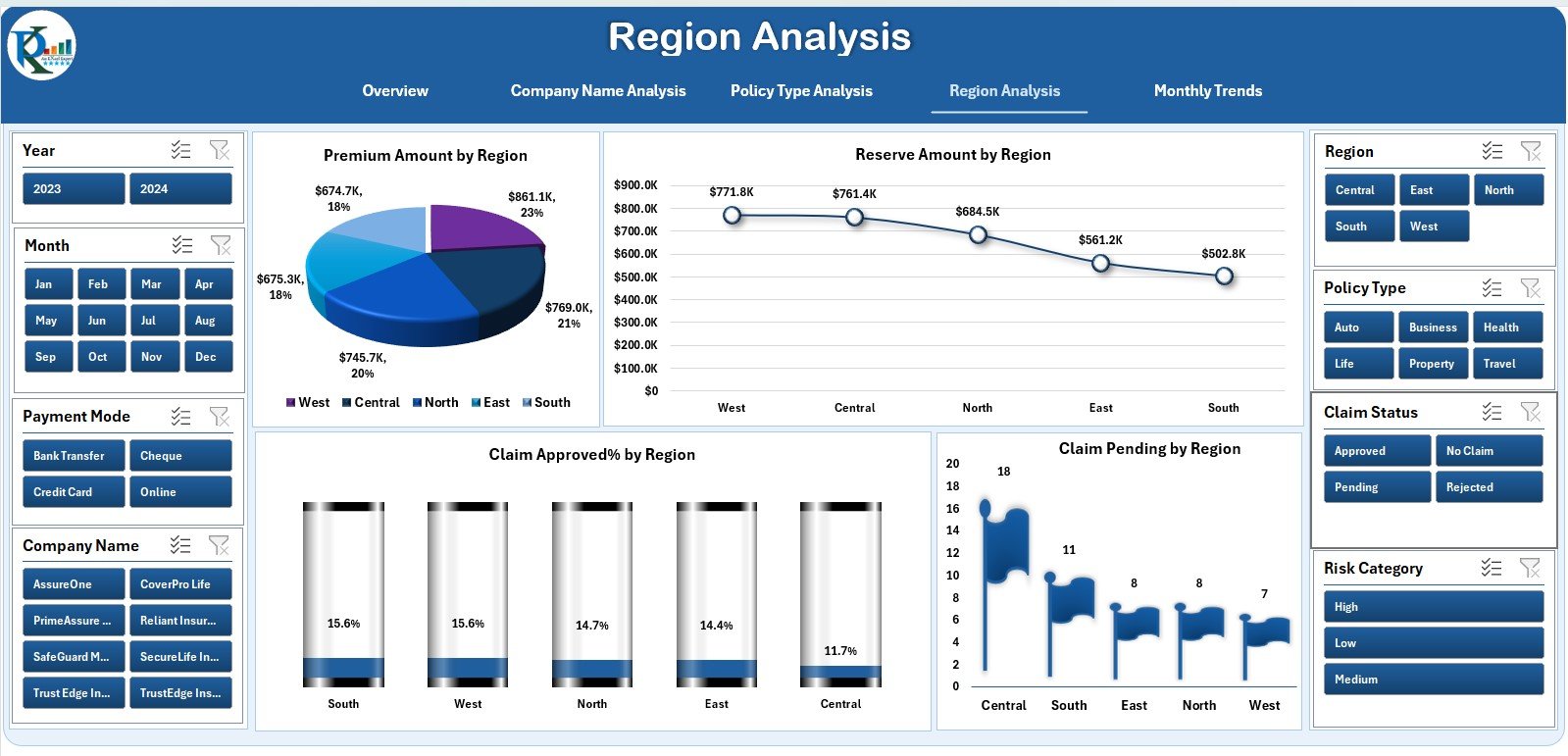

🌍 4️⃣ Region Analysis — Identify Geographical Risk

Gain a location-based view of business performance:

-

Premiums by Region

-

Reserve Amount by Region

-

Claim Approved % by Region

-

Pending Claims Count by Region

📊 Purpose: Detect risk hotspots and optimize regional pricing.

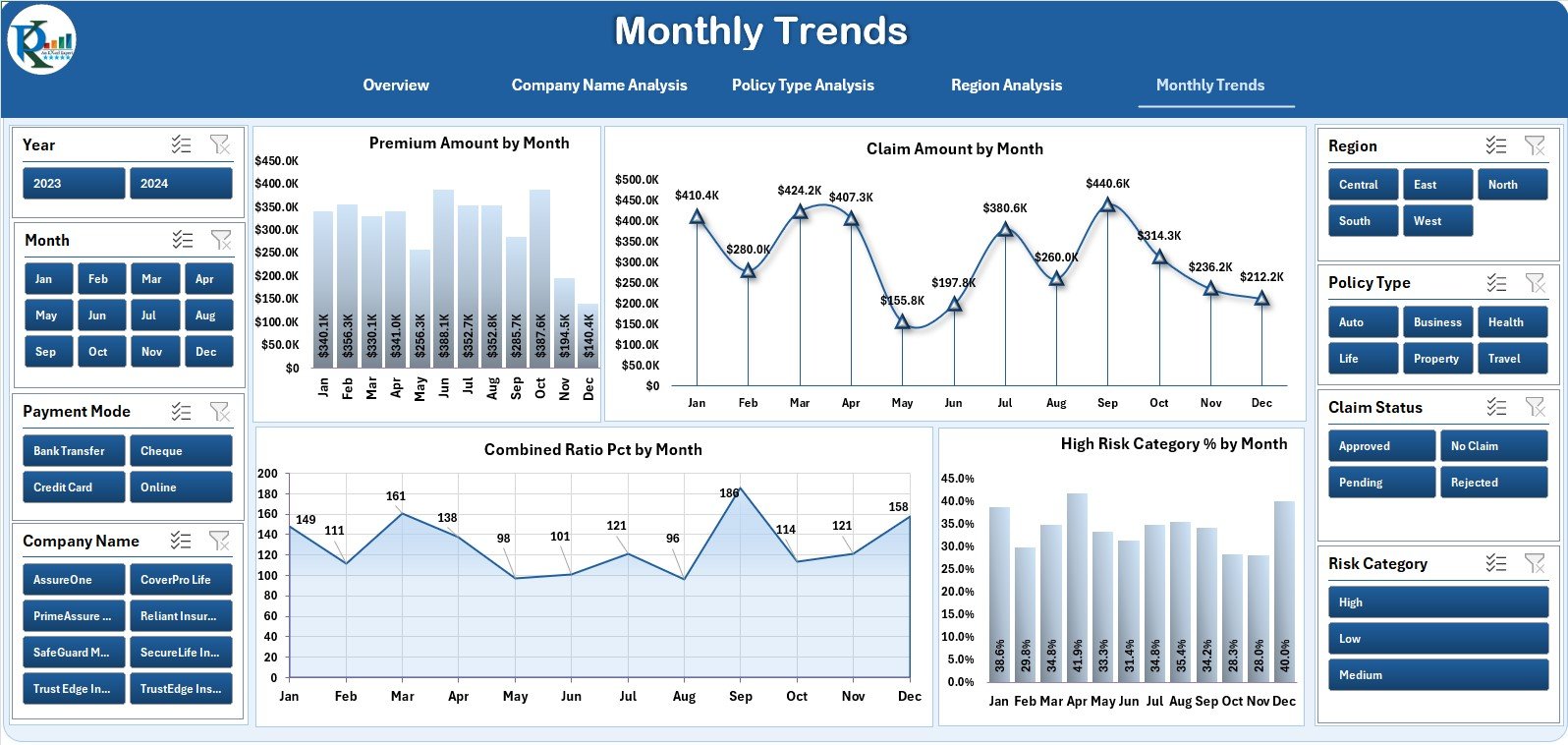

📅 5️⃣ Monthly Trends — Time-Series Performance

Monitor operational KPIs month-by-month:

-

Premium Amount by Month

-

Claim Amount by Month

-

Combined Ratio % by Month

-

High-Risk Category % by Month

🎯 Purpose: Identify seasonal cycles, forecast trends, and plan budgets.

🧩 Supporting Sheets

-

Data Sheet: Core transactional data for premiums, claims, and reserves.

-

Support Sheet: Stores reference data like policy types and regions.

Together, these power the entire dashboard dynamically.

🌟 Advantages of the Actuarial Services Dashboard

✅ Centralized Performance Tracking – View all actuarial KPIs in one structured file.

✅ Automated Analysis – Dynamic charts update instantly when data changes.

✅ Data-Driven Risk Management – Identify high-risk segments with visual cues.

✅ Enhanced Transparency – All departments share consistent performance views.

✅ Cost-Efficient – Provides analytical power without expensive software.

✅ Easy Customization – Modify KPIs, add formulas, or integrate Power Query.

🧠 Best Practices for Maximum Accuracy

📌 Validate all claim and premium entries before analysis.

📌 Define KPI targets clearly (e.g., Combined Ratio ≤ 95 %).

📌 Review Monthly Trends regularly for early warnings.

📌 Share insights with Finance, Risk, and Operations teams.

📌 Use slicers to filter by region, company, or policy.

📌 Back up data to cloud storage for version control.

👥 Who Can Benefit

👩💼 Actuarial Analysts & Consultants – Perform detailed risk and premium analysis.

🏢 Insurance Companies & Brokers – Monitor performance across portfolios.

📊 Risk & Finance Teams – Align claims data with business targets.

🎓 Academic Institutions – Teach actuarial modeling and reporting techniques.

💡 Why Excel Works Best for Actuarial Analysis

-

Familiar and flexible for quick modeling.

-

Supports complex formulas, pivot tables, and charts.

-

Easy to share, modify, and audit.

-

Integrates seamlessly with Power BI or databases when scaling up.

Reviews

There are no reviews yet.