Managing cash flow is one of the most important financial responsibilities of any business. Whether you run a small startup, a retail store, a consulting agency, or a manufacturing unit, you need complete visibility into how money enters and leaves your business. Without a structured system, financial decisions become risky and unpredictable.

That’s why we created the Cash Flow Template in Excel

Get complete control over your business finances using this powerful Cash Flow Template in Excel.

-

📈 Track monthly cash inflows & outflows — get real-time visibility

-

💰 Automatic net cash & closing balance calculations — zero manual work

-

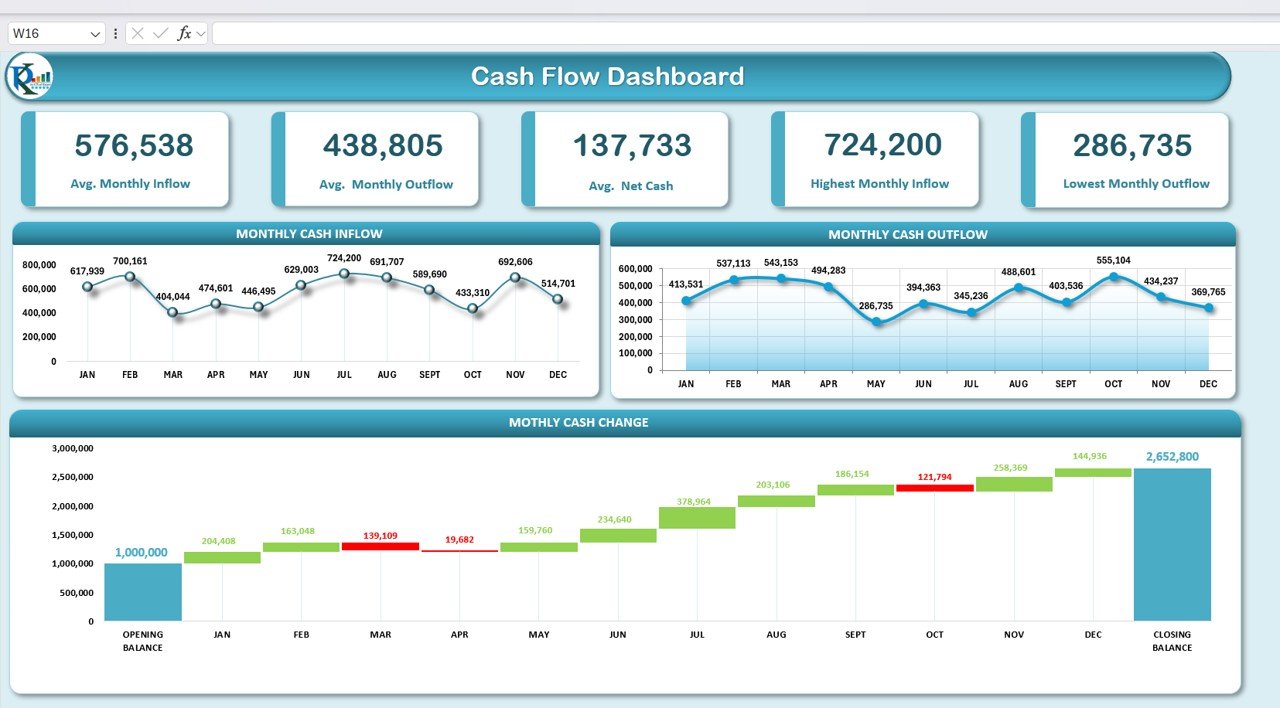

📊 Professional dashboard — view KPIs and monthly trends

-

🔄 Waterfall chart included — understand movement from opening to closing balance

-

🧾 Simple Data Entry sheet — easy for beginners

-

🏷 Custom inflow & outflow categories — adapt to any business

-

📉 Identify low-liquidity months — plan smarter decisions

-

💼 Suitable for any industry — retail, services, manufacturing & more

-

🧠 Perfect for budgeting & forecasting — improve financial planning

-

🛠 No coding required — fully automated and ready to use

—a simple, powerful, and ready-to-use tool that helps you monitor monthly cash inflows, cash outflows, net cash, and closing balances with full accuracy. This template provides automated calculations, clean layouts, and a professional dashboard so you can instantly understand your financial health.

If you’re looking for a reliable, beginner-friendly, and highly effective financial tracker, this Cash Flow Template will transform how you manage your business cash.

💡 Key Features of the Cash Flow Template in Excel

This template is designed with practical financial tracking needs in mind. Every feature helps businesses improve decision-making, reduce manual work, and gain real-time clarity.

📌 Automated Cash Flow Calculations

All inflows, outflows, monthly changes, and closing balances are calculated automatically. No need for complex formulas.

📌 Simple Data Entry Structure

The Data Entry sheet is clean, organized, and easy to update. Just enter the numbers—everything else updates instantly.

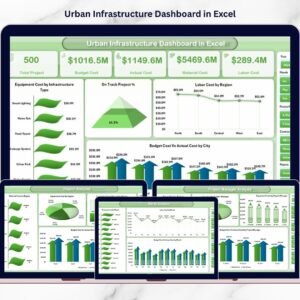

📌 Interactive Financial Dashboard

View key performance indicators (KPIs), monthly trends, and a powerful Waterfall chart that visually explains your cash movement.

📌 Monthly Cash Inflow & Outflow Breakdown

Track revenue streams, expenses, loans, investments, and custom categories—all in one place.

📌 Works for Any Industry

Suitable for startups, SMEs, consulting firms, e-commerce brands, restaurants, manufacturers, service companies, and more.

📌 Beginner-Friendly & No Coding Required

Even users with basic Excel skills can manage it comfortably.

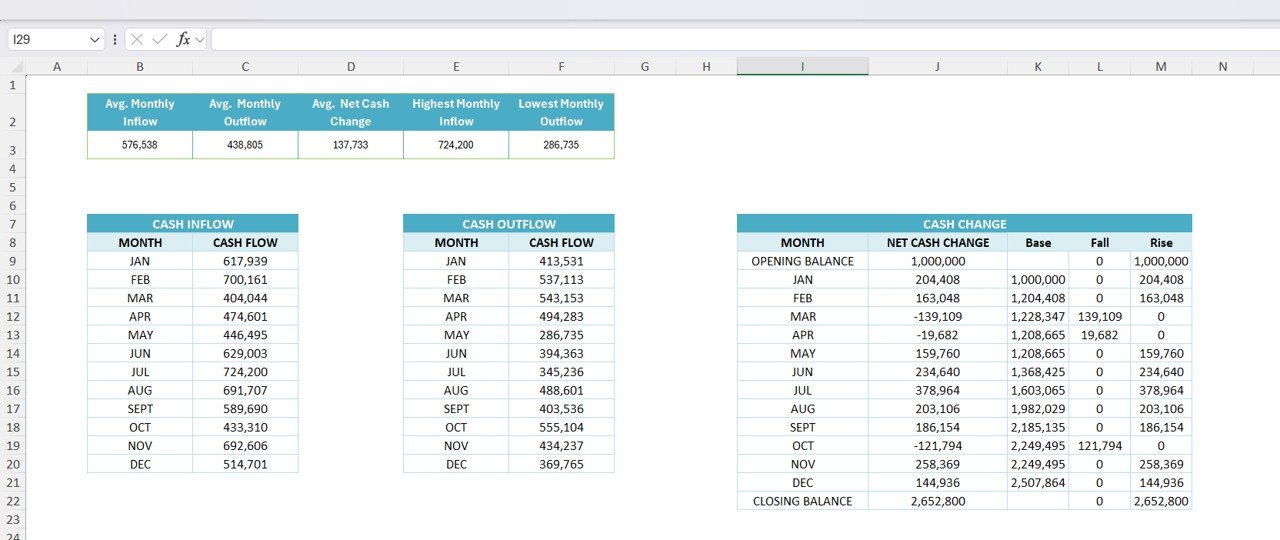

📘 What’s Inside the Cash Flow Template

This Excel file contains everything you need for accurate cash flow tracking.

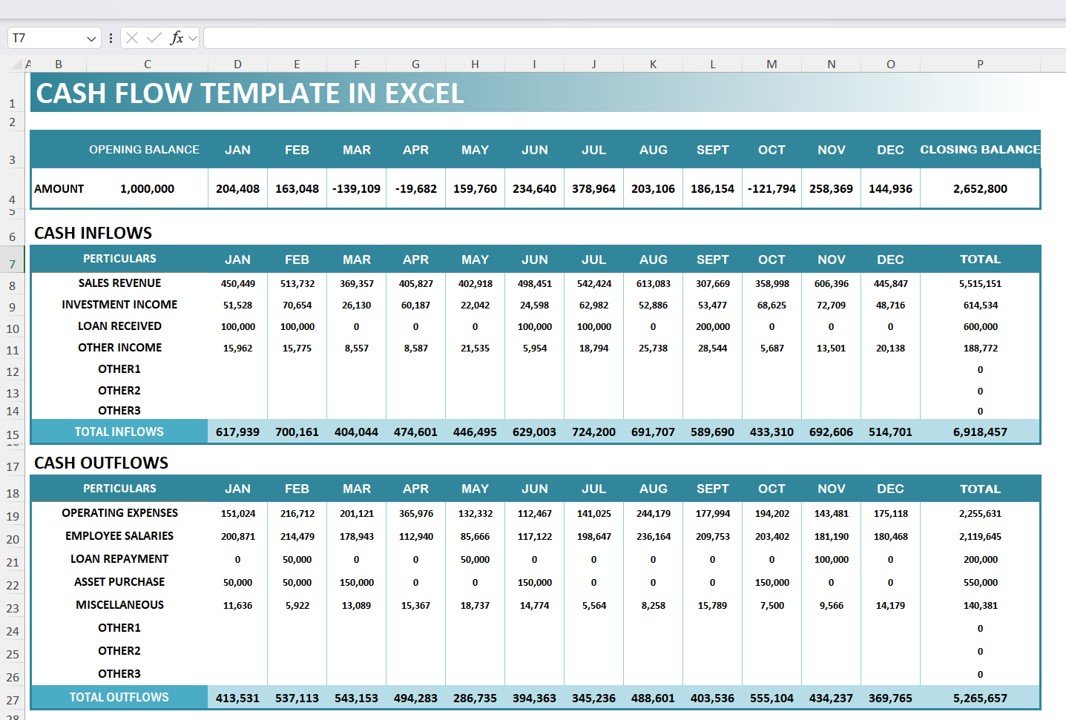

🧾 Data Entry Sheet (Main Input Page)

This is where you enter all monthly figures.

Includes sections for:

-

Opening Balance

-

Monthly Cash Inflows

-

Monthly Cash Outflows

-

Net Cash Change

-

Closing Balance

Inflows include:

✔ Sales Revenue

✔ Investment Income

✔ Loan Received

✔ Other Income (with custom fields)

Outflows include:

✔ Operating Expenses

✔ Employee Salaries

✔ Loan Repayment

✔ Asset Purchases

✔ Miscellaneous Expenses

✔ Custom Expense Categories

All totals update automatically so you always know your real-time cash position.

📊 Dashboard Sheet (Visual Insights)

The Dashboard displays clean financial insights using:

-

Average Monthly Inflow

-

Average Monthly Outflow

-

Average Net Cash Flow

-

Highest Monthly Inflow

-

Lowest Monthly Outflow

Charts Included:

📈 Monthly Inflow Chart

📉 Monthly Outflow Chart

🔄 Waterfall Chart (Opening to Closing Balance Journey)

This layout helps you quickly analyze trends and spot financial risks or opportunities.

🛠 How to Use the Cash Flow Template

Using this template is incredibly easy:

👉 Step 1: Enter the opening balance

Start your financial year with the correct opening amount.

👉 Step 2: Update monthly inflows & outflows

Add your income and expenses under the relevant categories.

👉 Step 3: Review net cash changes

See which months were strong and which months need attention.

👉 Step 4: Visit the dashboard

Use the charts and KPIs for financial planning, reporting, and evaluation.

👉 Step 5: Use insights for budgeting

Plan investments, control expenses, and build better cash strategies.

🎯 Who Can Benefit from This Cash Flow Template

This Excel-based template is ideal for:

-

🧾 Small Business Owners

-

🏢 Finance Teams

-

💼 Consultants & Freelancers

-

🏪 Retail & Wholesale Businesses

-

🏭 Manufacturing Units

-

📊 Accounting Professionals

-

🚀 Startups & Growing Companies

-

🧮 Students learning financial management

If you want transparency and better financial control, this tool is perfect for you.

Click here to read the Detailed blog post

Visit our YouTube channel to learn step-by-step video tutorials

Reviews

There are no reviews yet.